-

By Anil Trivedi

By Anil Trivedi

- February 4, 2025

- 0 Comments

- Tire Industry

Introduction

The global tyre industry is witnessing dynamic shifts driven by technological advancements, evolving consumer preferences, and regional economic policies. The European Tyre & Rubber Manufacturers Association (ETRMA) has provided valuable insights into the European tyre market’s performance in Q4 2023 vs. Q4 2024 and the full-year comparison of 2023 vs. 2024. This report examines these trends, their implications for global tyre trade, and strategic opportunities for Indian manufacturers eyeing the export market.

Quarterly (Q4 2023 vs. Q4 2024) Growth Trends

Consumer Tires: Increased by 12% (from 50.683 million to 56.516 million)

Car Summer Tires: Increased by 1%

Car All Seasons Tires: Increased by 18%

Car Winter Tires: Increased by 15%

Truck & Bus Tires: Increased by 4% (from 2.763 million to 2.882 million)

Agricultural Tires: Increased by 12% (from 136,000 to 152,000)

Moto & Scooter Tires: Increased by 18% (from 978,000 to 1.150 million)

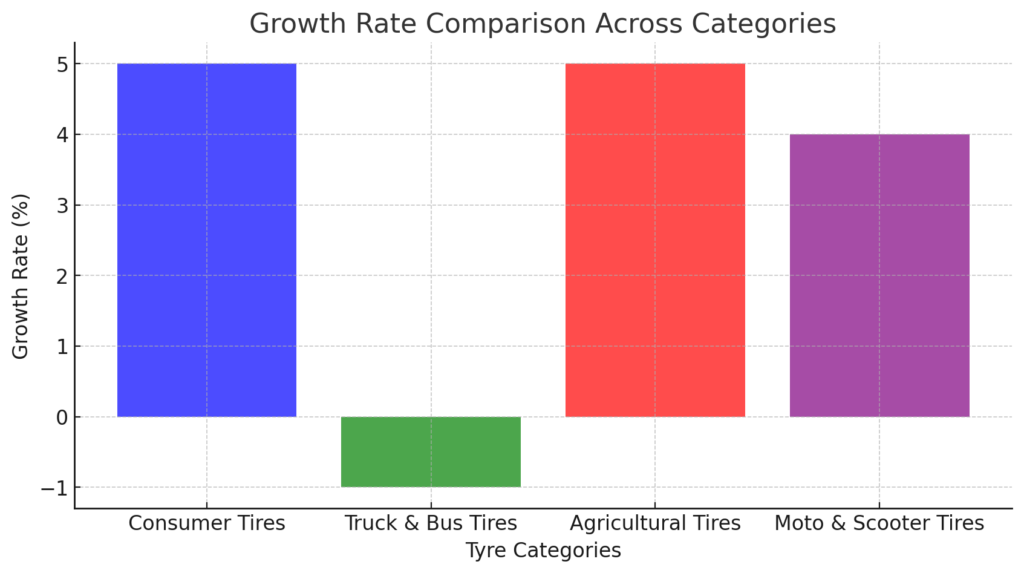

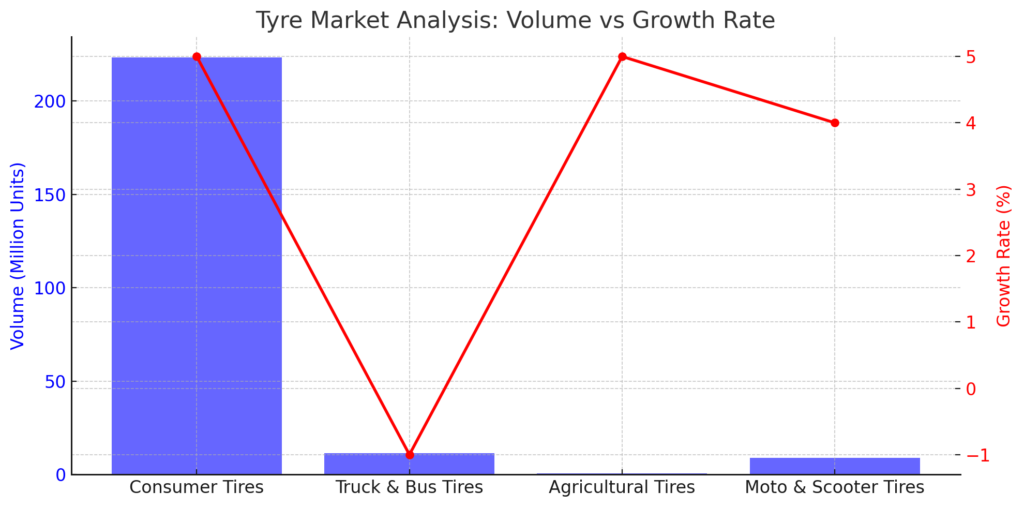

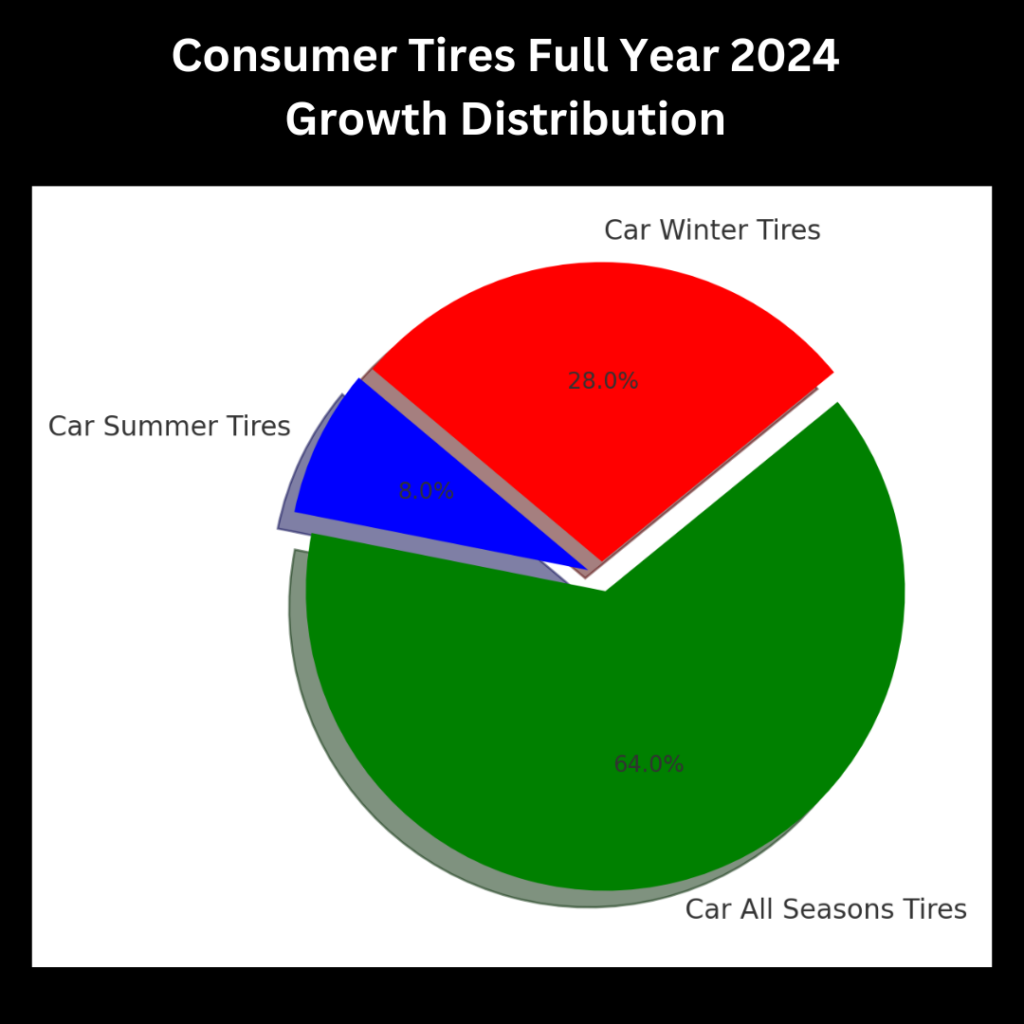

Full-Year (2023 vs. 2024) Growth Trends

Consumer Tires: Grew by 5% (from 212.265 million to 223.267 million)

Car Summer Tires: Declined by 2%

Car All Seasons Tires: Increased by 16%

Car Winter Tires: Increased by 7%

Truck & Bus Tires: Declined by 1% (from 11.390 million to 11.295 million)

Agricultural Tires: Increased by 5% (from 682,000 to 716,000)

Moto & Scooter Tires: Increased by 4% (from 8.658 million to 9.026 million)

2. Individual Category & Subcategory Analysis

Consumer Tires Analysis

Consumer tires represent the largest segment in the European market, accounting for over 80% of total tyre sales. The 12% growth in Q4 2024 indicates strong consumer demand, particularly for all-season and winter tyres

Shift Towards All-Season Tires

One of the most significant trends emerging from the data is the growing preference for all-season tires over traditional summer and winter tires. The 18% increase in Q4 and 16% growth for the full year underscore the rising consumer demand for versatile tires that eliminate the need for seasonal changeovers.

Several factors contribute to this shift:

Climate Variability: With unpredictable weather patterns, consumers prefer all-season tires that provide adequate performance in varying conditions.

Cost Efficiency: Purchasing and maintaining a single set of tires rather than switching between summer and winter options reduces expenses for consumers.

Improved Technology: Advances in tire manufacturing have made all-season tires more effective, narrowing the performance gap between dedicated summer and winter options.

Declining Popularity of Summer Tires

The data shows that car summer tires grew by only 1% in Q4 and actually declined by 2% over the full year. This suggests that consumers are moving away from seasonal summer tires in favor of all-season alternatives that provide sufficient performance in both warm and moderate winter conditions.

Winter Tires Still Have a Market but for Extreme Conditions

Despite the rise of all-season tires, winter tires remain essential in regions with severe winters. The 15% increase in Q4 and 7% growth for the full year indicate that customers still rely on them, but primarily in extreme conditions where regulations mandate their use. Many European countries enforce strict winter tire laws, ensuring continued demand in high-snowfall regions such as Germany, Scandinavia, and Eastern Europe.

Truck & Bus Tires Analysis

Q4 growth was 4%, but full-year sales declined by 1%, indicating seasonal fluctuations.

Volume: 11.295 million in 2024, making it a high-volume but low-growth sector.

Growth Opportunity: Indian manufacturers must focus on cost-competitive, durable truck tires for long-haul commercial vehicles in Europe.

Agricultural Tires Analysis

Q4 growth: 12%, Full-year growth: 5%

Volume: 716,000 units (2024)

Key Takeaway: Despite low volume, consistent demand growth presents a niche opportunity for Indian exporters specializing in durable, all-terrain agricultural tires.

Moto & Scooter Tires Analysis

Q4 growth: 18%, Full-year growth: 4%

Volume: 9.026 million units (2024)

Market Insight: With the rise in two-wheeler usage for urban mobility, demand for high-quality scooter and motorcycle tires is increasing across Europe.

3. Relating This Analysis to the Global Market

While the European market trends provide a key benchmark, understanding global tyre trade dynamics is crucial for Indian manufacturers. The European market is shifting towards all-season and winter tyres, while the truck and bus tyre segment remains stable but competitive. Here’s how Indian tyre exporters can capitalize:

Opportunities for Indian Manufacturers

All-Season Tires: The 16% annual growth in this segment suggests a lucrative export opportunity for Indian manufacturers who can offer quality, affordable alternatives to premium European brands.

Winter Tires: With 7% annual growth, the market is expanding due to safety regulations, especially in Germany and Nordic countries.

Truck & Bus Tires: Despite a 1% annual decline, the high-volume segment presents an opportunity for cost-effective, durable tyres designed for European regulations.

Agricultural Tires: A niche but growing market (5% annually) for Indian brands looking to supply OEMs and distributors.

Moto & Scooter Tires: The 4% annual growth presents an export potential for Indian firms specializing in fuel-efficient, high-performance two-wheeler tires.

4. Importance of Volume-Based Analysis Over Growth Percenta

When evaluating business viability, growth percentage alone is misleading. High growth in a low-volume category may not justify investment. Instead, volume must be the priority metric.

For example:

Car All Seasons Tires grew by 16%, but its volume increase was around 11 million units, making it a worthy segment.

Agricultural Tires grew by 5%, but their volume remains at only 716,000 units, making it less attractive than consumer tires.

Truck & Bus Tires saw a minor decline but maintained a massive volume of over 11 million units, highlighting stability and investment potential.

Thus, Indian exporters must target high-volume markets with sustainable growth instead of chasing small, high-growth segments.

Conclusion

The European tyre market presents substantial opportunities for Indian manufacturers looking to export high-volume, strategically growing tyre categories. The focus should be on all-season tyres, winter tyres, and commercial truck tyres, with a calculated approach to agricultural and scooter tyre segments.

By understanding the volume vs. growth dynamics and aligning products with European regulations and consumer preferences, Indian exporters can establish a strong market presence in Europe and beyond.